Posted by:

Kannan Jayaraman

Publish Date:

18 Mar, 2021

Brief

More public sector organisations are using analytics to gain deeper insights and provide better customer service, with the aim of reducing costs while minimising risks and customer complaints. But to drive a step change in handling issues with such public sector services, the current approach needs to be turned on its head. Instead of public sector analytics being focused on high-risk customers, the emphasis should be on identifying the other set. With Affirmative Scoring, you can do just that.

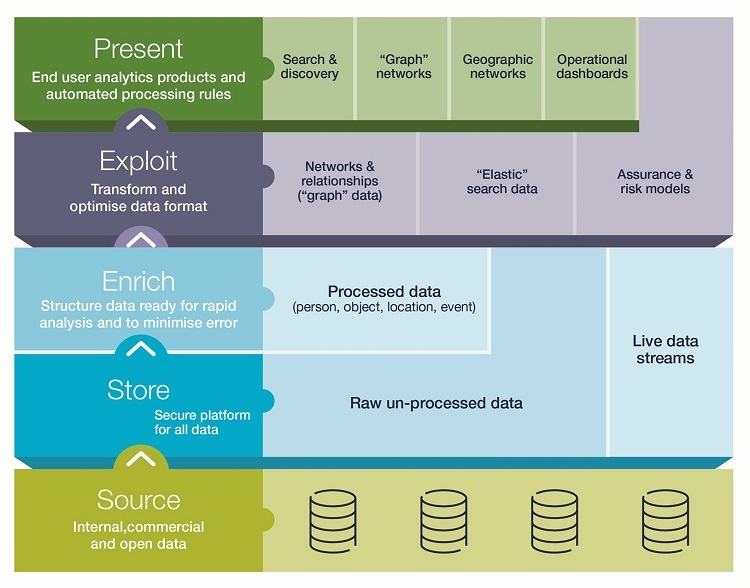

Figure 1. Affirmative Scoring Solution Platform

How does it work?

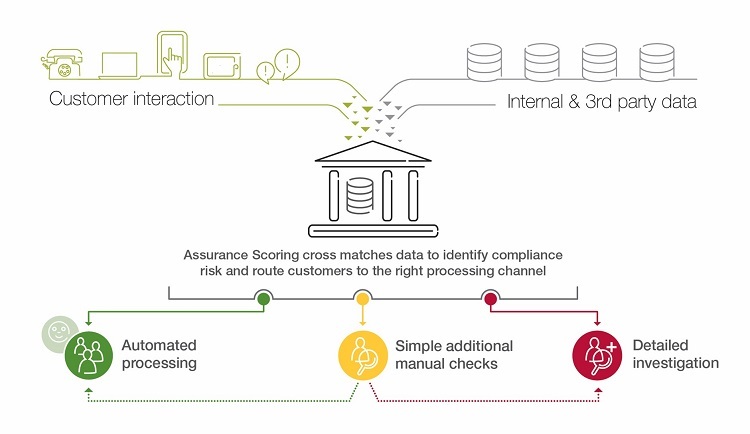

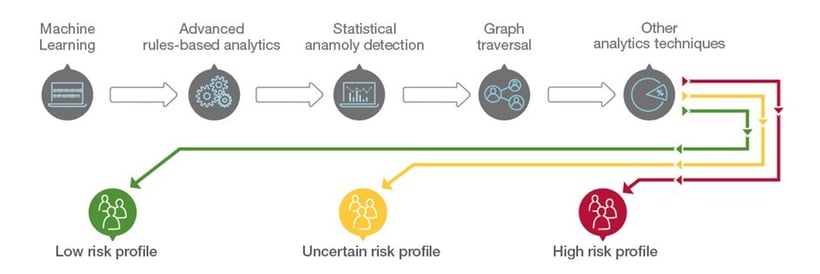

Affirmative Scoring applies analytics to historical data and real-time online behaviour - to find patterns that can’t be detected manually - to predict future behaviour and events. The wide range of analytics techniques – machine learning, statistical anomaly detection, graph transversal and others – ensure computing tools crosscheck and continually minimalise ‘false negatives’, to stop criminals who are masquerading as honest customers. There’s no such thing as ‘zero risk’, but this approach is very accurate and determines the level of automation or the type of specialist teams to involve, in simple or complex checks.

Figure 2. Affirmative Scoring Methodology

Affirmative Scoring makes it easy to implement analytics-enabled solutions. It uses advanced analytics to recognise customers who are identified as posing negligible risk. Typically, this enables over 90% of customer applications to be safely automated, so staff only devote their attention to activities associated with non-compliance or illegality.

Where is it applicable?

Affirmative Scoring can address the following business issues:

- Improve customer service, and reduce time and money in areas like processing customer applications (driving licences, passports, visas, benefits, funding for education), and transactions such as tax returns.

- Predicting potential fraud in tax, benefits, immigration, funding agencies or providers, commissioning service units in health care, and more.

- Identify troubled families, vulnerable adults, and socially isolated people; and take proactive measures to improve outcomes.

- Identify patient populations that need certain types of health care or services.

Affirmative Scoring is for organisations that process applications, validate declarations, or manage case work to identify which customers to process automatically, and when to use specialist teams for checks. It uses advanced analytics to segment customers for automated processing and more detailed risk assessments, and it provides technology accelerators to build a platform to ingest, organise and process data.

Figure 3. Affirmative Scoring combining analytical techniques

At the moment, our focus is to help public sector clients use Affirmative Scoring, but the capability is equally applicable to any organisation that wants to make efficiency savings by segmenting and processing low risk customers faster. By using Affirmative Scoring, valuable human resources can be diverted to tackling high-risk investigations.

Why Affirmative Scoring?

While traditional risk assessment in tax authorities and local governments focuses on individuals and corporations who are known to be have risk or fraud profiles. Affirmative Scoring looks at the entire population and applies analytics at scale. This allows tax authorities to identify taxpayers who are at risk, provide early warning of potential risk profiles that would otherwise be missed, and also help identify appropriate intervention strategies.

Seeing connections in this way enables better coordination across support agencies. It also helps identify and develop data-driven strategies for maximising tax revenue and reducing cost of debt collection.

You can explore insights from an innovation prototype proof of value solution in as little as eight weeks, with rapid prototypes using technology frameworks and working with data scientists to define your requirements. A full Affirmative Scoring solution links the data insights to processing rules which trigger service providers to take early action. This is where you can drive huge operational benefits, such as fewer emergency calls and care home admissions, the ability to target services to promote better wellbeing, and lower costs.

For more information on how we can help you to get a pilot off the ground quickly, or apply analytics to improve your tax collection services, please feel free to reach out to us here.