Posted by:

James Maysonet

Publish Date:

15 Feb, 2022

Video killed the Radio Star

Content financing is becoming the central topic of interest as the landscape changes to favor more streaming content while marginalizing exhibitors, cable, and television models. Leichtman Research Group reported in 2021, that about 78% of all U.S. households subscribed to streaming services such as Netflix, Amazon, and Hulu. Out of these 74% pay for more than one service. With that said, how do we manage the financial nuances of Direct to Streaming, Theatrical Releases, Television, and Home Entertainment Releases with the encroaching winds of change?

To know where we’re going, let’s evaluate where we’ve been. For the last 20 years, the entertainment industry has gone through a continuous evolution; a little over two decades ago, this industry was still selling VHS direct to retail and had just started the mass manufacturing and distribution of DVDs. The year was 1999. The domestic box office was about $7.3 Billion. The content owners couldn’t make discs fast enough; retail stores were maxed out of allocated space, and manufacturing would run 24/7 to produce tentpole titles. Today, the symbol of a VHS tape is used to determine a person’s age range and physical discs are sold as a specialty item on eBay. New markets rise while others stumble. As Schuyler Moore, a partner at Greenberg Glusker Fields Claman & Machtinger, recently said, “The studio model is gone, whoever controls distribution controls the keys to the kingdom. They get the money (directly from consumers) and decide who else gets how much money. And there’s a lot of discretion in the allocation.”

That statement is not only accurate but also explains the major impacts technology is having on the film & television industries’ revenue model. One obvious impact has been on the theatrical release model. The pandemic didn’t destroy the theatrical industry; it accelerated its downward trajectory, shortening the window between theatrical release and streaming/home viewing/VOD (viewing on demand). Any organization contracting top talent was tied to predefined requirements directly related to box office performance. However, with fewer theater screens available and more content going direct to streaming, margins are seeing a significant impact. This evolution places financial management and media rights and royalties’ management solutions in the eye of this evolving hurricane of content financial management shifting from talent, studio, and exhibitors to talent and streamers.

Regardless of the various monetization models, the studios, streamers, and aggregators are all operating under the same premise, building content libraries for consumers to watch. Consumers decide on what, when, and where to spend their dollars when it comes to content consumption, with brand, franchise, and content becoming the determining factors. Content is what will drive consumers to theatres, streaming, television, or any combination of the three. It’s like dining choices; when picking between fast-food, casual dining, or fine dining, it depends on time, budget, and taste. At the beginning of the pandemic, Disney+’s Hamilton proved that consumers would stream at home, and the recent Spider Man: No Way Home proved that people will go to theaters despite the spike in the COVID-19 Omicron variant.

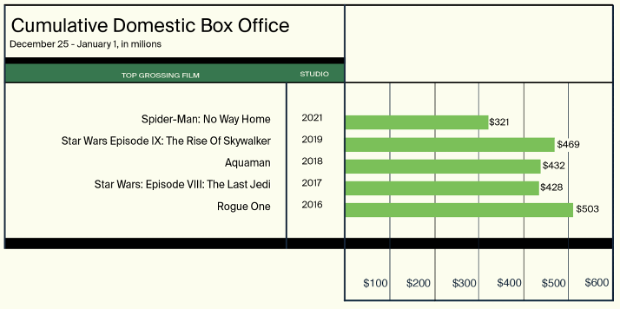

Reported by The Quorum, January 10, 2022

The subject of “what killed the theatre revenue” is not new—in fact, it’s been a debate for years. In 2005, theatre owners were blaming the drop in ticket sales on Best Buy’s marketing and sales of home theatre systems, studios’ DVDs and Blu-ray players, and Netflix’s inexpensive easy access to content by mail. Today, the pandemic has pushed some theatre companies either out of business or to the edge, but the fact is many have been struggling because consumer habits and demands have evolved.

“Facing strong headwinds, domestic box office revenue rose to $4.5 billion in 2021 as the theatrical business struggled to recover from the COVID-19 crisis. According to Comscore, revenue for 2021 was nearly 60 percent behind 2019 ($11.4 billion). And the last time domestic revenue came in at $4.5 billion was 29 years ago — in 1992. The box office recovery continues to be a slow process. The latest hurdle is the highly contagious Omicron variant. The rise of streaming is also an enormous challenge for cinemas.” Reported The Hollywood Reporter on January 1, 2022.

Outside forces disrupting an industry is not an occurrence unique to the theatrical industry. 66 years ago, another industry needed to evolve because of the Federal Aid Highway Act of 1956, popularly known as the National Interstate and Defense Highways Act. When President Dwight D. Eisenhower signed the bill into law on June 29, 1956, the authorization to build 41,000 miles of interstate highways marked the largest American public works program to that time.

As the highways were being built, many believed their construction would be the end of fine dining and mom & pop establishments as the freeways gave rise to fast-food chain restaurants. This perception is similar to what many today believe is happening to theatres, but the fact is fast-food, high-end, and casual dining still coexist, just as theatres, television, streaming and cable will for many years to come. Choices will be determined by the availability of the consumers’ time and budget. This constant evolution in consumption is having dramatic impacts upon the financial decisions and, in turn, the supply chain.

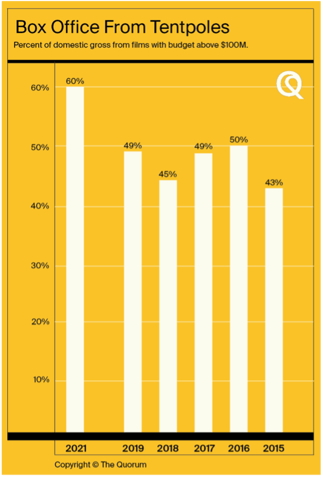

"We know there is still hesitancy to go to a theater among a large population, however, they will go for an event film. We can see it at the box office through a noticeable flight to tentpoles. Films with budgets over $100 million accounted for 60% of the box office in 2021. That's up from 49% in 2019." Said David Herrin, Founder of The Quorum.

If the comment that “theatrical, streaming, and home video will co-exist” is compared to the restaurant industry; theatrical is high-end dining, home video is casual/Mom & Pop dining and streaming is fast food. The opportunities are open, but the greenlight teams need to review the data early to determine which model will serve best its audience and budget.

When it comes to the theatrical model, there is a symbiotic relationship between the studios and theatre owners and both businesses will work on keeping the box office alive. Direct to streaming is not a new concept, as there has been content made for TV, direct to VHS, and DVD. What has changed is the financing required to supply the demand for streaming content and the growth of streaming companies. “The global streaming boom pushes up both demand and budgets for film and TV series.” Reported by The Hollywood Reporter, December 29, 2021.

The Business of entertainment is constantly evolving

Historically, especially at the convergence of digital and physical, the industry has come together to solve common issues within the content supply chain. Here are a few to remember:

- Interoperability issues across devices on which consumers view content across the globe – The Society of Motion Picture and Television Engineers (SMPTE) developed a standardized file-based format master version for global distribution known as Interoperable Master Format (IMF)

- Content Security – Content Distribution Security Association (CDSA)

- Data governance – Entertainment Identifier Registry Association (EIDR)

- Localization – Language Metadata Table (LMT)

- Netflix’s new authoring format, Timed Text Authoring Lineage (TTAL), streamlined data exchange and file management for subtitling and dubbing

- Forecasting/Planning/Acquisitions – Analytics through Data scientists and AI

- Avails – Rights Management Tools

- Disparate Supply Chain Network – SAP Business Network

- Workflow breakage and choke points – Cloud Processing

- Asset Management – MAMs or DAMs – Organize and archive digital content, audio, visual, creative, images. Designed to store, find and share digital assets.

The fire has been lit, can you handle the fire hose?

The entertainment industry’s supply chain is designed to execute repeatable processes, but scaling is its current challenge. Between synchronizing all the data points across the value chain during the entire lifecycle, automating hundreds of business processes around the thousands of transactions, and processing the millions of transactions generated by a greenlighted concept, organizations need integrated and scalable systems to enable the financial processes critical to their viability.

Irrespective of the model, business units are required to maintain the supply chain to meet the demand. Most personnel handle varying types of content with an equal amount of urgency, unless, of course, it is a tentpole title, but more and more content is skipping theatrical and going direct to streaming. Demand for a hit series can suddenly create pressure to produce content that is very lucrative for the streamer but this increase in volume has also brought management of costs, budgets, and accounting more scrutiny.

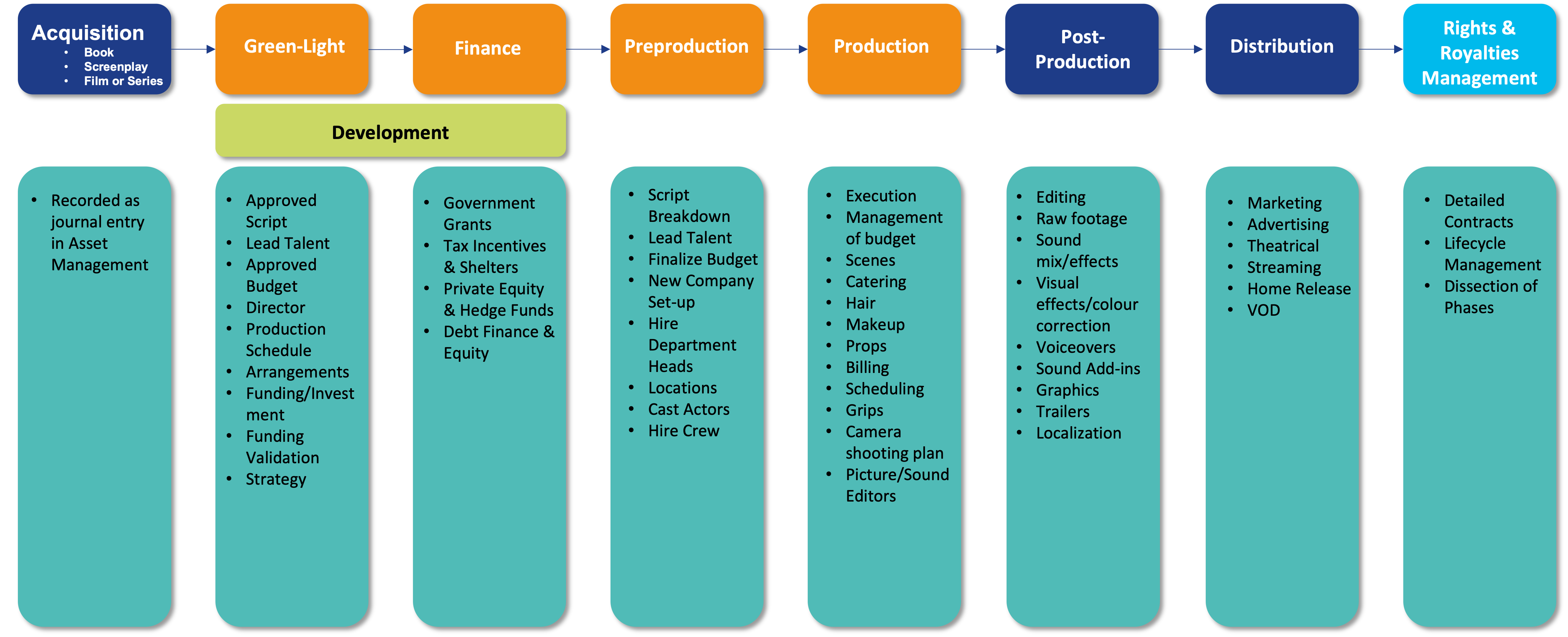

Along every step of the value chain, there are tasks, documents, and financial events connected to a very complex workflow. From the point of ideation to the point of distribution, and every step in-between, all decisions have a financial impact, especially around production finance, budgeting, and accounting that require more near real-time processing and data visibility to manage overall budgets and decisions. The figure below shows essential components of the content value chain.

Every greenlight drives budgets and deals, those deals drive contracts and incentives, those contracts drive production, and those incentives drive financial commitments and tax management. Production requires purchase orders and payroll, and the chain continues through the content lifecycle to post-production deals, streaming, distribution, rights & royalties management, and beyond. Currently, most of these workflows are managed by separate systems and require individual manual inputs – a critical flaw that prevents scaling. The tools that manage financing, budgeting, and production are in dire need of advancement and integration, as many of these tools and the processes they support are antiquated, single-purpose, not easily accessible, and lack the capability to manage the demands of today.

To truly enable scaling, the industry needs new tools, integrated, in-memory, and on mobile devices.

Action: Enter a solution for managing the entire content lifecycle

In the last 20 years, the subject of finance, budgeting, and accounting has not been the focus in the public arena. The Content Supply Chain is a very broad subject, with digital workflows and content security in fashion for good reason. The financial supply chain, however, is what enables every detail of this industry and what needs to scale, integrate, and automate. Introducing Content Financials; built on the world-class SAP S/4 HANA ERP platform and leveraging all its standard functionalities and state-of-the-art technology. This is a tailor-made solution for Media & Entertainment companies, making it one of the most sought-after solutions in this space.

From a Finance point of view, content management solution offerings are the must-haves for these organizations. The solution offers:

- Financials by title (revenues, expenditures, margins against plans and budgets).

- Budget Management: Tight budget control, over budget alerts, and approvals for overspend.

- Integration of all production costs whether payroll, external workforce, supplies, or equipment.

- Streamlined and automated invoicing and payment processes.

- Automatic Intellectual Property Inventory recognition as per defined business rules

- Telecast-based Amortization (only what gets telecasted, gets amortized)

- Embedded high quality and high-speed drag and drop analytics

- Cash and liquidity management.

Managing risk, maintaining speed from production to delivery, and being within budget have been the name of the game since the beginning of supply chain management. Some names given to it include media orchestration, digital supply chain, value chain, and media chain. Regardless of what you call it, this process requires connectivity, visibility, and financial management.

Integrating a solution capable of managing the entire content lifecycle would be a smart move given what an ERP like SAP S/4 HANA can deliver in scale, speed, and connectivity across all the chains.

SAP integration to digital workflow tools from acquisitions to management to delivery is easily achieved.

Yes, we have cloud services, so much cloud in fact that it’s raining opportunities at every corner. But the right model must fit the need. Discussions around in-sourcing parts of the digital supply chain are being had, mainly due to cloud costs decreasing, though when it comes to recording, editing, and archiving, and asset management, scale is also key to a successful supply chain, regardless of in- or outsourcing. From the creators to distributors, through aggregators and beyond, the need to manage the volume of transactions and their financials is critically important to the survival and growth of an organization.

This is where invenioLSI can help

invenioLSI brings a fresh perspective to the North American M&E market, combining expert technical skills, finance, and organizational change management; we deliver a catered service to every partner, guiding them through this confluence of voluminous demand, complexity and choke points. Our teams have direct access to leadership given that invenioLSI is management owned and everyone is aligned to meet the goal of making our customers successful. Our work may be broad, but it has depth in managing some of the most complex change management situations, pushing teams forward with the technology, processes, and communication tools to be successful. We have driven measurable results in many finance/accounting institutions, while having undertaken and delivered on projects that resulted in long-standing trusted relationships with our clients.

Ask yourself: are you solving a business problem or are you more interested in the lowest price? Sometimes one solution can do both, but too many times, this low-price tunnel vision results in low solution adoption and a costly problem to solve.

Solving a business problem is becoming the lead issue being addressed today rather than chasing low price. Change management, adoption, and ease of use are all at the front of the focus requirements invenioLSI is asked to facilitate. invenioLSI’s Content Financial product was built with the design guidance being:

- Simple to use for the production accountant

- Ease of training

- Intuitive user experience

- Clear features and functions for each action

The variability and complexity of the content production process is considered in the design, ensuring an integrated solution captures the details as well as the dynamic changes in deals, finance, and production.

This is only sampling of the complete SAP S/4 HANA solutions in the content financial supply chain. Content Financials include:

- Acquisitions

- Development

- Production

- Distribution

- Amortization

For decades, effective supply chains adapt to the changing landscape to be more collaborative and nimbler, but one thing is for sure: only those who have the right tools will not only survive, but also remain competitive. Content owned, licensed, produced, and distributed by global media companies, streamers, and cable operators all need to leverage their ERP systems to solvency.

About the author

James Maysonet, VP of Media and Entertainment

James is an expert at re-engineering business processes and aligning practices to reflect corporate vision and mission by introducing innovative solutions. Over 20 years of executive experience in the Media & Entertainment Industry with complex Supply Chains, Global Strategic Road-maps, Data Governance, and Business Operations. James has worked with high-tech manufacturing, retail, Major Film & Streaming companies, Major Video Game Publishers, the Music Industry and Content Security.

James held executive positions within Metro-Goldwyn-Mayer Studios, Sony Pictures, Netflix, Teradata & Capgemini Consulting.