Posted by:

Sahil Sidhwani

Publish Date:

12 Jul, 2022

In any taxation ecosystem, one of the key responsibilities of a tax regulatory authority is the collection of taxes from eligible taxpayers.

With polar interests, it seems inevitable that in the course of tax collection by authorities, and the payment of taxes by taxpayers, there’s plenty of opportunity for disagreement. This inevitability makes a sound dispute resolution framework essential to balancing these interests and achieving a symbiotic relationship within the ecosystem.

Any effective Dispute Resolution Framework needs to be capable of resolving disputes between the authority and the taxpayers that may arise from:

- Under/over calculation of taxes, interests, and penalties

- Payment/recovery of taxes

- Non-compliance by the taxpayers

- Over/under deduction of taxes

The implementation of SAP Tax and Revenue Management (TRM) and Public Sector Collections and Disbursements (PSCD) solutions enable tax authorities to achieve the objectives of tax compliance and realization. Consequently, the SAP technology must be used yet again to effectively manage the Tax Dispute Resolution of these authorities.

In a typical tax economy, tax legislation enables taxpayers to resort to any or all of the below options to initiate disputes towards the decisions made by the tax authority having implications on them:

- Objections

- Appeals to Tax Appeal Committee (‘TAC’)

- Appeals to Court

In this blog, we will discuss the importance of SAP in enabling tax authorities to effectively manage the disputes received as “Objection Requests” from taxpayers. In the above pre-defined context, the business uses of SAP can be classified under the two broad categories as discussed in the below excerpts:

SAP as a tool for providing a seamless Taxpayer Experience

For any taxation authority, a key focus is the provision of hassle-free automation to taxpayers. The adoption of SAP and allied technologies enables authorities to deliver a technology-driven tax portal for their taxpayers.

The below points will elaborate on how the tax portal is designed and implemented effectively to cater to the need for a committed tax dispute resolution framework :

1. Inclusion of Tax Legislation: It is essential that any ERP system accounts for all the applicable laws, processes, policies, and procedures right from the outset. SAP-TRM and PSCD modules have proved effective in meeting this need through the incorporation of processes and applicable laws within any tax legislation. One such example is the creation of effective Ui5 screens backed by the SAP Business Rule Framework (BRF) +, ABAP, and WD pro technologies which are tailor-made for the inclusion of dispute resolution laws via implementation of “Objection Application”.The SAP TRM and PSCD solutions enable taxpayers to file an objection request against various decisions of the tax authority, including:

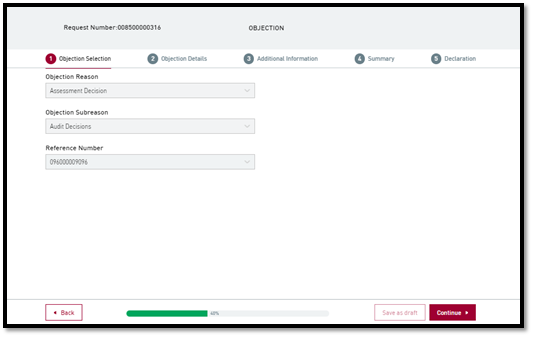

a. Objection against Assessment Decision: These are decisions made by the tax authority after assessing the return of income for a particular period for the taxpayer.

The assessment of return via an Audit Case is also carried out and communicated to the taxpayers using SAP solutions.

Figure 1: Taxpayer Portal depicting ‘Objection Against Assessment Decision’ Application

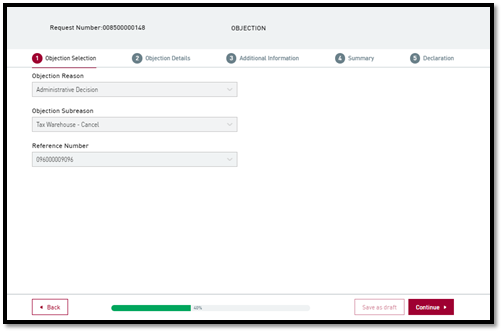

b. Objection against Administrative Decision: The decisions concerning non-acceptance of any tax-administrative application filed by the taxpayer, are objected to by the taxpayer under this category. For instance, rejection of “Tax Warehouse Cancellation Application” by the authority on certain grounds.

Figure 2: Taxpayer Portal depicting ‘Objection Against Administrative Decision’ Application

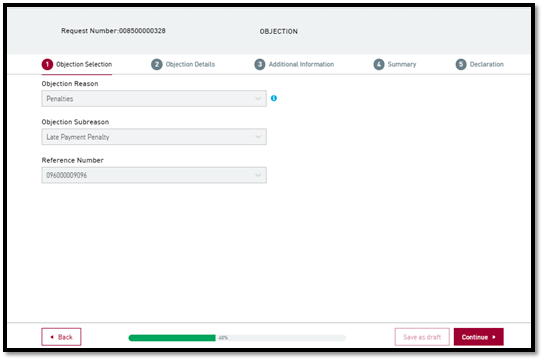

c. Objection against Penalties: Here, the taxpayer can file an objection against non-compliance penalties levied by the tax authority under this category. Penalties for late registration, late lodgment, late payment and so on,are included in this category.

Figure 3: Taxpayer Portal depicting ‘Objection Against Penalties’ Application

2. User-friendly Screens: The screens have been designed taking into account the mindset and expectations of taxpayers. The use of an easy navigation tool helps users switch between various sections of the application to make the process of filing the objection hassle-free for the taxpayers.The screens are self-explanatory with proper instructions, help icons, and terms and conditions, enhancing taxpayer experience and encouraging taxpayers to be more tax-compliant.

3. Additional tools for a great taxpayer experience: SAP technology is intricately designed to provide two-way communication between the taxpayers and the tax authority. The application enables taxpayers to provide additional information and to attach supporting documents for validation. This way, the system ensures effective communication for informed decision-making in the avoidance or resolution of disputes.

SAP as a tool to effectively manage and respond to disputes by Authorities

SAP TRM and PSCD solutions offer a gamut of benefits to its end users. So far, we have considered its importance from the taxpayers’ point of view, but how has it been leveraged by tax authorities?

1. Interactive Screen for Tax Officials: As discussed above, the solution makes use of Ui5 technology to create taxpayer screens for submitting an objection request. However, by combining SAP Fiori and WebDyn Pro technologies, it becomes equally useful to tax officers in the assimilation and analysis of information, enabling them to make robust and informed decisions. The standard SAP Fiori Inbox is provided to the officers to access the applications assigned to them to take further action.2. Case History and Overview: The solution and the screens provide a holistic view of each taxpayer’s case and, with all of the relevant information in one place, it becomes easier for tax officers to make sound decisions around:

Objection request details such as objected items, objected amounts, and more

Previous case history pertaining to each taxpayer, such as inspections or investigations

All relevant documents received from the taxpayer

Taxpayer 360° overview (for comprehensive view)

3. Collection of Information/Clarification: The solution has been designed to facilitate the tax authorities’ need to contact the taxpayers and request additional information or clarification during decision-making. Therefore, the solution makes it possible for tax officers to quickly and easily request such information with just a few clicks. Once a request is made by the taxation authority, the taxpayer is notified electronically and they can equally easily submit the requested information by accessing the tax portal

4. Summoning the taxpayers: The system is capable of facilitating the in-person availability of taxpayers in the office. This makes tax officer decision-making fast and reliable. The system will mandate the tax officer to record meeting minutes and send the case for further approvals, thus, ensuring a greater degree of transparency.

5. Conducting tax inspection: One such distinguishing feature of the SAP TRM and PSCD solution is its capability to initiate an on-premises visit of tax officers. This proves to be an effective way for the collection and analysis of information received from the premises of the taxpayers. The solution also allows the tax officer to record tax proceedings or field visits which can, later, be used and processed while completing the assessment.

6. Analytical Reports: Our solution is equipped with modern data analysis tools. SAP BI tools enable enhanced decisiveness by compiling a huge volume of taxpayer requests into well-organized and presented BI reports. These reports present comprehensive data in a much simpler summarized format, which can be accessed in real-time.

Conclusion

We can see that SAP has again proved to be an effective tool in managing tax disputes in the country. With the advent of effective technology-driven state-of-the-art solutions and zilch of human intervention, tax authorities can now offer a better taxpayer experience that improves digital citizen engagement and provides a robust and efficient Tax Dispute Resolution System.